Getting The Insurance Agent In Jefferson Ga To Work

Table of ContentsInsurance Agent In Jefferson Ga Fundamentals Explained3 Simple Techniques For Insurance Agent In Jefferson GaInsurance Agent In Jefferson Ga for DummiesNot known Details About Home Insurance Agent In Jefferson Ga

According to the Insurance Coverage Info Institute, the typical yearly cost for an auto insurance plan in the United States in 2016 was $935. 80. Typically, a single head-on collision can cost thousands of dollars in losses, so having a plan will certainly cost much less than paying for the accident. Insurance policy additionally assists you prevent the decline of your automobile. The insurance policy safeguards you and assists you with claims that others make versus you in crashes. The NCB could be supplied as a discount on the costs, making cars and truck insurance extra affordable (Life Insurance Agent in Jefferson GA).

A number of factors influence the costs: Age of the car: Oftentimes, an older automobile prices less to guarantee compared to a newer one. New automobiles have a higher market value, so they cost even more to fix or replace.

Particular lorries routinely make the regularly swiped listings, so you may have to pay a greater premium if you possess one of these. When it comes to cars and truck insurance policy, the 3 primary kinds of plans are liability, accident, and extensive.

Rumored Buzz on Life Insurance Agent In Jefferson Ga

Some states call for vehicle drivers to bring this coverage (https://www.indiegogo.com/individuals/35719954). Underinsured motorist. Similar to without insurance coverage, this policy covers damages or injuries you receive from a vehicle driver who does not bring enough protection. Motorbike insurance coverage: This is a plan especially for bikes since car insurance coverage does not cover bike crashes. The advantages of car insurance far surpass the dangers as you could end up paying thousands of bucks out-of-pocket for an accident you trigger.

It's generally much better to have even more protection than not sufficient.

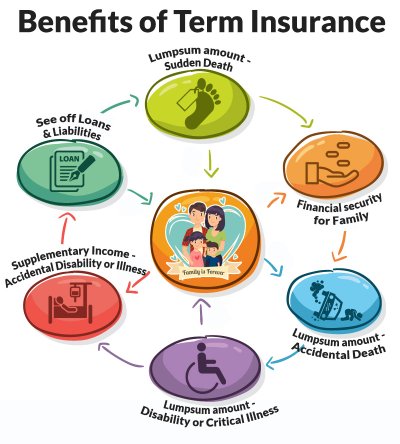

The Social Protection and Supplemental Safety Revenue impairment programs are the biggest of numerous Federal programs that give aid to individuals with handicaps (Home Insurance Agent in Jefferson GA). While these two programs are different in many methods, both are carried out by the Social Protection Management and just people that have a special needs and satisfy medical criteria may qualify for benefits under either program

A succeeding evaluation of employees' payment cases and the level to which absenteeism, spirits and working with good workers were troubles at these companies reveals the positive effects of offering health and wellness insurance coverage. When contrasted to companies that did not offer health insurance policy, it appears that using emphasis caused renovations in the capability to hire excellent workers, reductions in the variety of workers' settlement cases and reductions in the level to which absenteeism and productivity were troubles for emphasis companies.

Auto Insurance Agent In Jefferson Ga Things To Know Before You Buy

Six reports have actually been launched, consisting of "Care Without Protection: Too Little, Far Too Late," which finds that working-age Americans without health insurance are more probable to obtain inadequate healthcare and receive it also late, be sicker and die sooner and receive poorer treatment when they remain in the health center, also for severe scenarios like a car crash.

The study writers also keep in mind that expanding insurance coverage would likely lead to a rise in actual source expense (despite that pays), since the without insurance get concerning half as much treatment as the privately guaranteed. Health Matters released the study online: "Just How Much Treatment Do the Without Insurance Usage, and Who Pays For It? - Home Insurance Agent in Jefferson GA."

The obligation of offering insurance policy for workers can be a challenging and occasionally expensive job and numerous local business think they can't afford it. However are advantages for staff members required? What benefits or insurance coverage do you lawfully require to provide? What is the difference between "Worker Conveniences" and "Staff member Insurance"? Allow's dive in.

Insurance Agent In Jefferson Ga for Beginners

Employee benefits normally begin with medical insurance and team term life insurance coverage. As component of the wellness insurance coverage plan, a company might opt to supply both vision and oral insurance policy. None of these are required in most states, employers offer them to remain competitive. A lot of potential employees aren't mosting likely to help a firm that doesn't give them accessibility to basic healthcare.

With the climbing pattern in the cost of health and wellness insurance policy, it is sensible to ask employees to pay a percent of the coverage. Many businesses do position most of the expense on the employee when they supply accessibility to medical insurance. A retired life strategy (such as a 401k, Basic plan, SEP) is normally supplied as a staff member advantage.